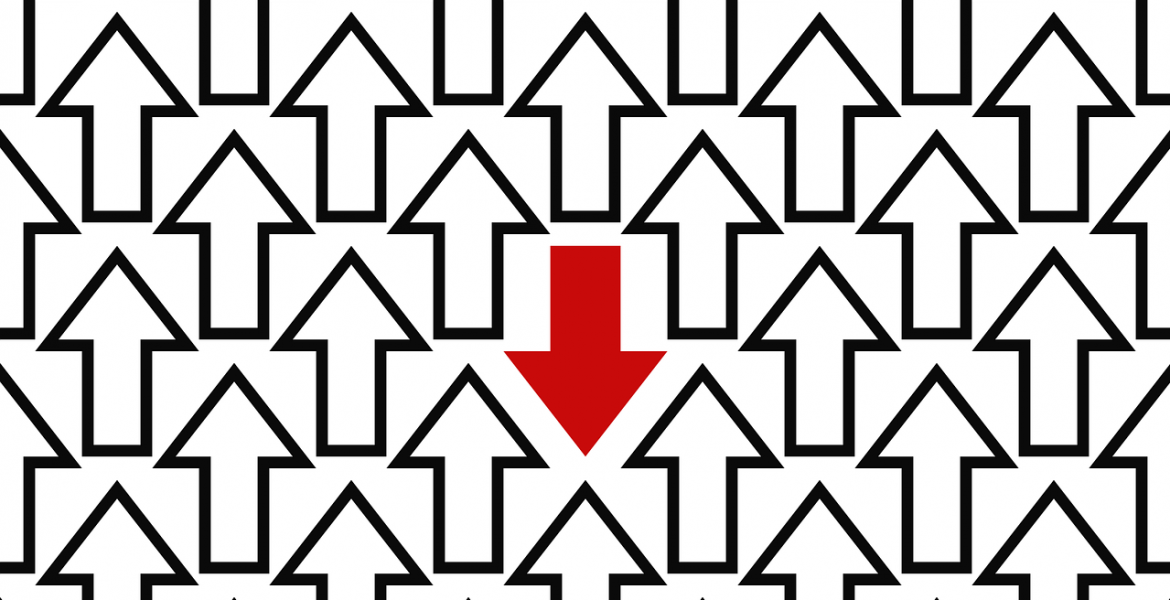

If you’ve been in the trucking industry for a while, you probably agree that this past year has felt like riding on a roller coaster. Whether it’s been international trade wars, a once-in-a-century global pandemic, or extreme weather events, there have been too many interruptions and unexpected downturns to name them all, and that’s not even getting into the once in a generations being brought by technology advances and other factors. All this uncertainty has made it harder than ever to predict what’s going on with the key metrics in the freight industry, such as load-to-truck ratios, van, reefer, and flatbed rates, or fuel prices.

The roller coaster continued in March, as the industry enjoyed record highs in a number of important categories, such as flatbed rates. So it should come as no surprise that the spot market dipped in April. Let’s take a look at exactly what April’s markets looked like, the reasons why, and what can be expected as the summer progresses.

No matter what happens from week to week and month to month in the trucking industry, it pays to remember that the best thing that smart drivers and business owners can do to navigate the wild swings is to find the right partners.

What is the trucking spot market?

One of the important concepts that truckers need to understand is the difference between the freight spot market and the freight contract pricing market. These are two options for shippers to negotiate their rates, each with its own advantages.

By using contracts, this provides a shipper with greater cost certainty, as well as making it possible to lock in capacity well in advance. The spot market makes it possible to move freight with little advance notice, allowing for greater flexibility. It’s also possible to save money with the spot market, though this is not always the case and shippers should proceed cautiously, especially when they are new to the industry.

The spot freight rate is defined as the price to move freight from one place to another at that particular point in time. A contract rate allows the shipper and freight broker to lock in an agreed upon rate over a particular period, perhaps weeks or even months (typical contracts last for a 12-month period, though other lengths are not uncommon).

To better understand how the spot rate works, it really comes down to one of the most basic economic principles, supply and demand. The greater the need for a particular commodity, the higher the price, whereas the more you have of something, the cheaper it becomes. For those into freight logistics, it’s necessary to look at individual shipping lanes, i.e. the volume of shipments between two cities, as there is more than one way to analyze supply. It’s necessary to know approximately how much cargo needs to be shipped, while also keeping track of the available trucks to do the shipping. This is where the load-to-truck ratio comes in.

All this (and more) comes into play when calculating the spot rate. The spot rate for a shipment usually comes down to how much cargo needs to be moved in a particular lane and how many trucks are available at the moment. Because this can vary so greatly at any given time, this is why many shippers prefer to rely on contracts so that they can have greater cost certainty throughout the year.

Where can truckers find up-to-date spot market data?

For individual truckers, trying to keep track of so many heady economic figures can be outside of their area of expertise. For this reason, they rely on one of several freight load boards that keep track of the current spot market, in addition to have important numbers, such as fuel rates, load-to-truck ratios, and more.

There are a number of options for truckers to stay abreast of the latest changes. The most famous of course is DAT Solutions. Formerly known as Dial-A-Truck, this is one of the largest freight load boards in North America, and their website offers frequent updates on the freight spot market.

But there are other options as well, including InTek Freight And Logistics and Freight Waves.

March saw record high rates in the trucking industry

To get a good perspective on the truckload volume in April, it’s first necessary to be familiar with the situation in March. After severe winter storms that slammed much of the country, including the North East and huge parts of Texas and other southern states, March saw freight indicators rebound in a major way. For instance, van spot rates increased by 30 cent over the February average. For flatbed rates, it was much the same, with a 14-cent increase, while reefer rates jumped by 26 cents.

When you combine the rebound from the February storms with the general optimism created by the gradual reopening of the economy after record lows caused by the Covid-19 pandemic, the result is that March was in fact a record month. According to DAT statistics, the van and reefer line-haul rates saw seven-day averages that were unprecedented. This is the backdrop that we must understand when looking at the volumes for April.

Spot market dip in April not unexpected

With the record performance in March, it would not be unexpected for a dip to follow. But when you couple that with the fact that April is traditionally a month that sees a decrease in spot market truckload volume, it should come as no surprise that is exactly what happened.

Compared with March, twenty-foot equivalent unit (TEU) volume was down nearly 4%. Furthermore, when looking at just the top ten markets around the country, volume was down by 5% on the spot market. As a specific example, the weekly outbound load post volume dropped by 4%, with spot rates correspondingly jumping by 12 cents per mile, for a total average of $2.65 per mile. In Memphis, volume was also down by 4%, with the spot rate jumping to $2.84 per mile, while in Lakeland, the volume was down a whopping 13% with rates jumping 9 cents per mile to $2.10.

While the volume was down when compared to the previous month, if we look at the numbers year-on-year, we’re still enjoying a tremendous recovery after a disastrous 2020. In fact, the month of April enjoyed 31% greater volumes than the pandemic-shuttered economy of 2020. With May a traditionally stronger month compared to April, it’s expected that the rebound will continue moving forward.

Saint John Capital Understands The Trucking Industry

Now more than ever, we’re living in a connected world that relies on large amounts of data. This is just as true of the trucking industry as it is in any other. But successful trucking companies need more than data to succeed. They also need the right partners. That’s where Saint John Capital comes in. We have worked exclusively in the trucking industry for two and a half decades, helping drivers and fleet managers better manage their cash flow so they can grow their business.

Our number one goal is to assist our customers as they navigate the frequent ups and downs of the freight industry, which has especially been the case the past year. Our financial support makes it easier for you to concentrate on your strengths. With Saint John Capital’s specialized services, including freight factoring, fuel cards, and an easy-to-use load finder, our clients have the freedom to achieve growth and dream of bigger things ahead.

Contact us today to learn more about how Saint John Capital can help your trucking business thrive.