If you’ve ever been to dat.com, you know that load-to-truck ratio is an important concept. It’s a term you’ll see a lot on their site, and you’ll come across throughout the trucking industry, but even so, many people aren’t sure what exactly it means.

DAT Solutions was founded in 1978, when it was known as Dial-A-Truck (DAT). It started out as a load finder service at Jubitz truck stop in Portland, Oregon. Through the many changes that the industry has gone through in the last 40 years, DAT has retained its position as the central marketplace where people in the transportation industry make transactions in the spot market. In addition to connecting drivers and shippers, DAT also provides data analysis, including their monthly spot market freight index and Trendlines updates.

As part of their data output, DAT measures the load-to-truck ratio on their site. This indicates the number of load posts on their load boards divided by the number of truck posts. A higher ratio can mean a number of things. It can indicate when there are a lot of load posts. It might mean there are very few truck posts. Usually, it’s a combination of both.

On the other hand, the ratio goes down when there are fewer loads, or more trucks are available. In general, their data has shown that the load-to-truck ratio is highest for flatbeds, with reefers next, and vans coming in third. Their findings support the notion that brokers have the most difficulty finding flatbeds and that there generally are more vans available than both flatbeds and reefers put together.

Why Do People Pay Attention To The Load-To-Truck Ratio?

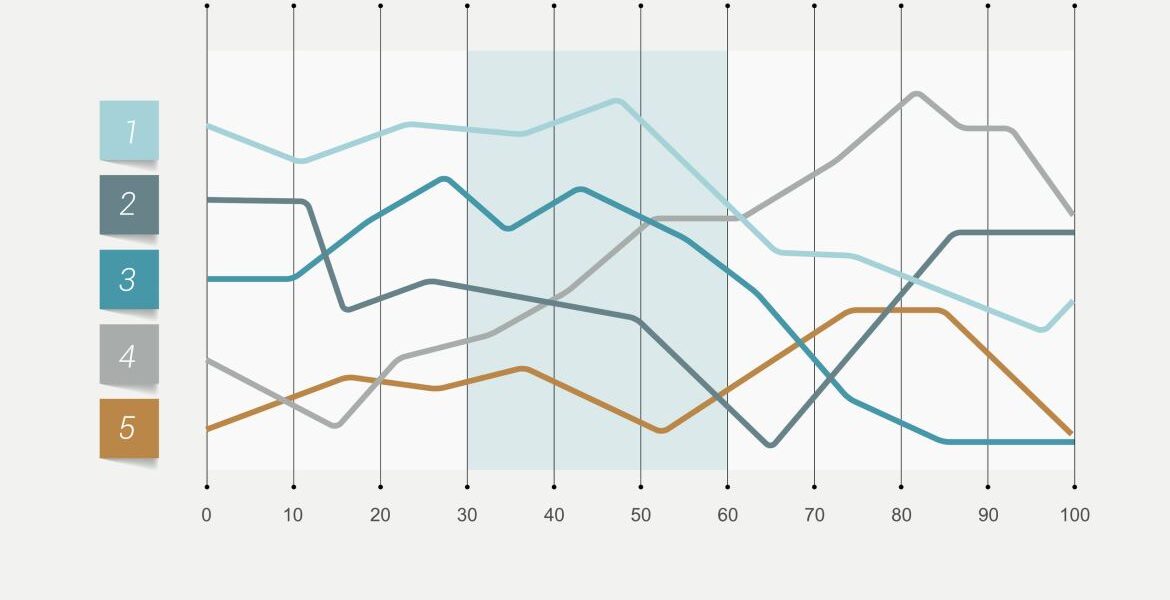

The importance of the load-to-truck ratio is how it describes the balance between freight availability and truckload capacity in the spot market (a spot shipment is one quoted and contracted immediately in the moment, or on the spot). DAT updates the ratio constantly and is therefore able to find emerging trends in the market very quickly.

In fact, it has been shown that DAT’s load-to-truck ratio is able to show a 90% correlation with the spot market rate. This means that the DAT info can help industry insiders make timely estimates regarding the spot market and where it may be moving in the immediate future.

Of particular importance, when the load-to-truck ratio increases, the rates usually go up at the same time. In fact, the trend is actually more relevant than the specific number. Over time, DAT has found that the load-to-truck ratio follows the same pattern as national van rates.

How Specific Does DAT Get With The Data?

Users are able to get info on the DAT load-to-truck ratio in many forms. You can search by equipment type at the nationwide, state, or key market (or city). You can search for a particular day, week, or month. They even put out data visualizations and maps that allow you to get an overview of outbound load-to-truck ratios geographically. They have info for 135 key market areas.

Other interesting features that they offer for subscribers include one-day Hot Market Maps, showing the previous business day. You can even choose your own time frame to create infographics tailored to your needs at DAT Data Analytics Services.

Does A High Load-To-Truck Ratio In A Market Mean A Better Rate For Truckers?

A high ratio doesn’t necessarily mean truckers will get better rates. This is because it’s also important to look at the actual number of loads and trucks posted. In markets where there are many more trucks and loads, this will have a definite impact on the rates compared with smaller markets.

As an example, Medford, Oregon, is a small market that frequently has a high load-to-truck ratio. Compared to Medford, the outbound ratio in Los Angeles is much lower. At the same time, the market in LA is much bigger, with as many as three times as many loads posted at any given moment. Rates will tend to be higher going into a smaller market such as Medford because it will likely be harder to get a shipment going out. This difficulty will be reflected in the outbound price from LA.

What all this means is that while you can learn a lot just by looking at the load-to-truck ratio, it’s also important to assess the full range of data to make accurate predictions and observations.

How Does This Information Help You Choose A Load?

Smart truckers will stay up to date on the load-to-truck ratios when planning their next few routes. Say you’re choosing between a load to Chicago or one to Indianapolis. You might make slightly more driving to the former, but learn that you can make more on the return trip to the latter. That’s an important way to increase your average rate over several trips.

You can also look into building a triangular route, say driving from Memphis to Houston, from Houston to Dallas, and then return from Dallas to Memphis. Another popular trick is to find a short, high-value route and drive back and forth between them several times. Being strategic in this manner will earn you much more in the long run than just taking the best paying route available at that moment, because that may lead you to lower paying routes on your return, and lower your overall average.

Remember, load-to-truck ratios can go really high when there’s an urgent demand for trucks. Your best bet is to follow the trends and try and anticipate where the market will be in the next few days and weeks.

Saint John Capital Understands Trucking

At Saint John Capital, we make it our business to understand the trucking industry. Because we work exclusively within the industry, we have a deep knowledge of the needs of our customers. That allows us to provide customized services directly to the truckers who need them most. Every carrier, big or small, needs to find value everywhere they can, and we can help with our many great factoring options, fleet card programs, and other services that will save you both time and money.

Contact us today to learn more about Saint John Capital.